The Top Attributes to Look for in a Secured Credit Card Singapore

The Top Attributes to Look for in a Secured Credit Card Singapore

Blog Article

Charting the Path: Opportunities for Bank Card Accessibility After Insolvency Discharge

Browsing the world of credit card accessibility post-bankruptcy discharge can be a complicated job for people wanting to rebuild their monetary standing. The procedure entails strategic planning, understanding credit scores score complexities, and discovering different options offered to those in this specific situation. From protected bank card as a tipping rock to potential courses causing unprotected credit scores opportunities, the trip towards re-establishing credit reliability needs careful factor to consider and educated decision-making. Join us as we discover the avenues and approaches that can lead the way for individuals looking for to reclaim accessibility to bank card after facing insolvency discharge.

Recognizing Credit Rating Essentials

A credit history score is a numerical representation of a person's creditworthiness, indicating to lending institutions the degree of threat linked with expanding debt. Several elements add to the computation of a credit history rating, including repayment history, amounts owed, length of debt background, brand-new debt, and kinds of credit history made use of. The quantity owed relative to readily available credit report, likewise understood as credit scores application, is one more important aspect affecting credit report ratings.

Safe Credit Report Cards Explained

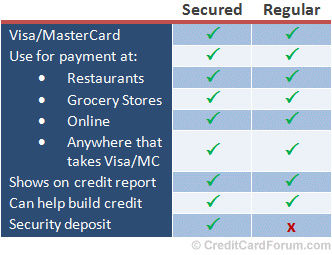

Protected bank card supply a valuable financial device for individuals aiming to restore their credit scores history adhering to a bankruptcy discharge. These cards need a protection down payment, which typically figures out the credit limitation. By making use of a protected bank card properly, cardholders can show their creditworthiness to potential lending institutions and gradually enhance their credit rating.

One of the essential benefits of protected bank card is that they are extra easily accessible to people with a restricted credit scores background or a ruined credit rating - secured credit card singapore. Given that the credit line is safeguarded by a down payment, issuers are a lot more prepared to accept applicants who might not certify for standard unprotected credit history cards

Charge Card Options for Restoring

When looking for to restore credit after bankruptcy, exploring different credit score card choices customized to individuals in this economic scenario can be advantageous. Safe credit scores cards are a preferred choice for those looking to rebuild their credit rating. An additional choice is becoming a licensed individual on someone else's credit history card, permitting individuals to piggyback off their credit report background and potentially improve their very own rating.

Exactly How to Receive Unsecured Cards

To qualify for unsafe charge card post-bankruptcy, people require to show enhanced credit reliability with liable find monetary management and a background of on-time settlements. One of the primary steps to get unsafe credit report cards after personal bankruptcy is to consistently pay expenses on time. Timely repayments showcase responsibility and integrity to prospective creditors. Maintaining reduced charge card equilibriums and preventing building up high degrees of debt post-bankruptcy additionally improves creditworthiness. Keeping track of credit score records regularly for any kind of errors and challenging errors can even more improve credit history, making individuals extra appealing to charge card companies. Additionally, individuals can consider looking for a safeguarded credit report card to reconstruct credit. Protected bank card call for a cash deposit as security, which minimizes the danger for the company and enables people to show accountable charge card usage. Over time, responsible economic practices and a positive credit report can lead to credentials for unsecured credit scores cards with better incentives and terms, assisting individuals reconstruct their monetary standing post-bankruptcy.

Tips for Liable Credit Score Card Usage

Building on the foundation of boosted credit official site reliability established with responsible monetary monitoring, people can enhance their overall monetary well-being by executing crucial tips for responsible credit history card usage. Furthermore, preserving a reduced credit rating use proportion, ideally listed below 30%, shows responsible credit scores usage and can positively impact debt scores. Avoiding from opening several new credit card accounts within a brief period can protect against prospective credit rating damage and too much debt build-up.

Conclusion

In conclusion, individuals that have declared bankruptcy can still access charge card through numerous alternatives such as safeguarded bank card and rebuilding credit report (secured credit card singapore). By recognizing credit report essentials, certifying for unsafe cards, and practicing accountable credit report card usage, individuals can gradually rebuild their creditworthiness. It is essential for individuals to thoroughly consider their monetary situation and make educated decisions to improve their debt standing after insolvency discharge

Numerous variables add to the estimation of a credit history score, including settlement history, amounts owed, length of credit score history, brand-new debt, and types of credit report used. The quantity owed relative to available credit, additionally understood as credit scores utilization, is an additional vital factor affecting credit score ratings. Keeping an eye on credit score reports consistently for any mistakes Learn More Here and disputing mistakes can better enhance credit history scores, making individuals extra appealing to credit history card providers. Additionally, maintaining a low credit score usage proportion, preferably listed below 30%, shows accountable credit rating usage and can positively affect credit rating ratings.In final thought, individuals who have actually submitted for personal bankruptcy can still access credit scores cards via various choices such as protected debt cards and rebuilding debt.

Report this page